Welcome to Newsweek‘s cryptocurrency news: in this daily update we will be looking at the movement and outlook for major cryptocurrencies, including Bitcoin, with a technical analysis.

Meanwhile, the Newsweek Cryptocurrency Index has data on 11 currencies, with individual strength comparisons.

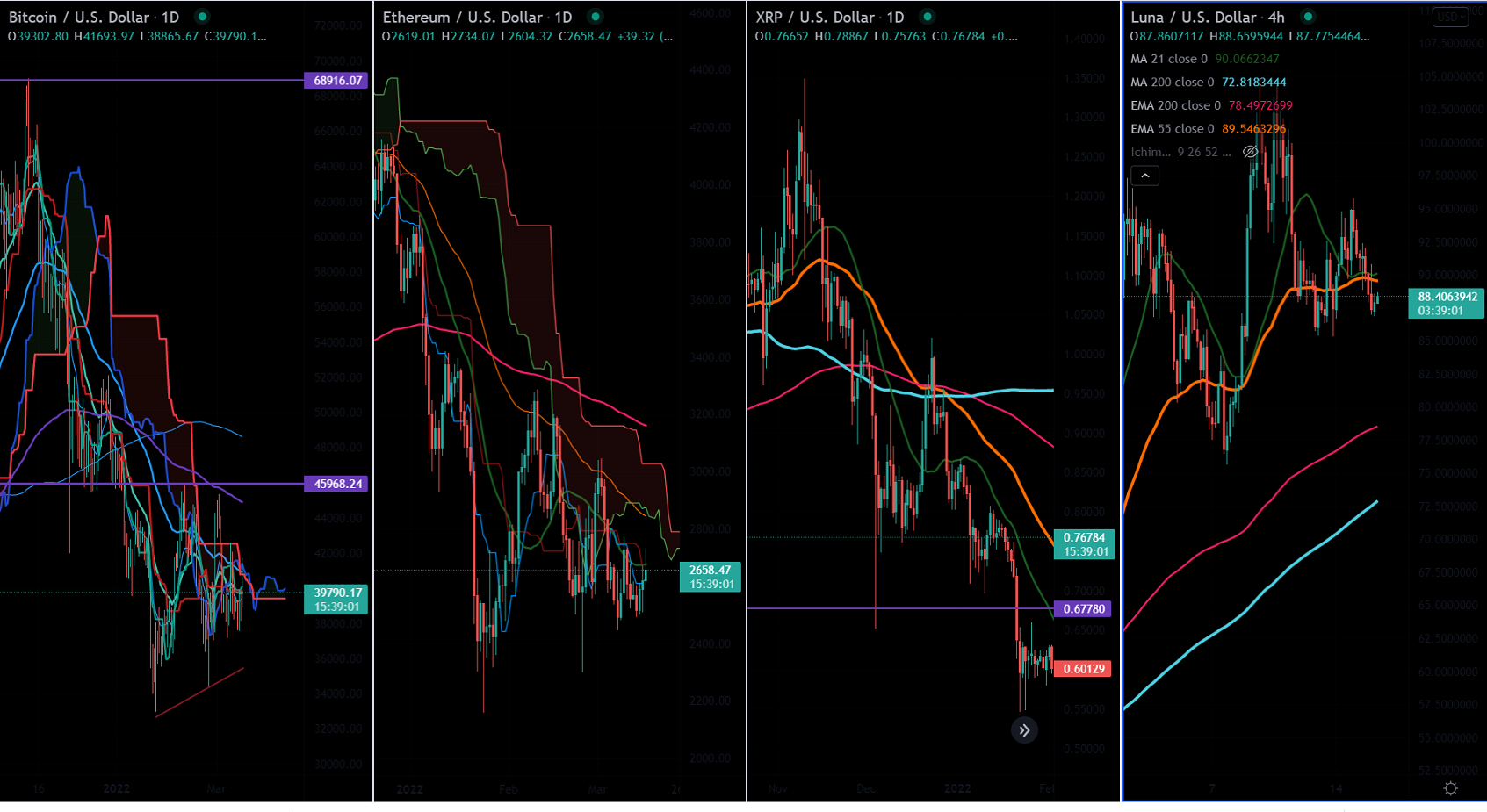

Bitcoin (BTC/USD) Outlook

Key Highlights

Bitcoin edged above $40,000 ahead of the Fed’s monetary policy meeting on Wednesday. The U.S. central bank is expected to hike rates by 25 basis points, and markets will scrutinize Fed chairman Jerome Powell’s commentary for further direction.

The fourth round of talks between Russia and Ukraine ended up without any conclusion.

Technical Analysis

Intraday trend – Bullish

In the daily chart, the pair is trading above Tenken-sen ($39,880), Kijun-sen (39,828), and below Ichimoku Kumo cloud ($41,025) confirming the minor bullish trend. It hits a high of $41,673 at the time of writing and is currently trading around $40,536.

Major support is seen at $37,000 (Mar 7th low). Any drop below this level would revert to the previous bearish conditions, with a possible dip to levels of $34,000/$32,950 (Jan 24th low)/$30,000/$28,600.

Intraday trend reversal may happen if Bitcoin closes above $41,700. A jump to $42,600 (Mar 9th high)/$45,356 (200- day EMA)/$50,000 is possible.

TradingView

RSI- neutral

It may be good to buy on dips around $40,000 with SL around $37,000 for TP of $50,000.

ETH/USD Daily Outlook

Key Highlights

ETH/USD has been trading in a narrow range between $2,774 and $2,492 for the past week.

On the daily chart, the pair is trading below Tenken-sen ($2,627), Kijun-sen ($2,672), and Ichimoku Kumo cloud ($2,870), confirming the minor weak trend. It hit a high of $2,734 at the time of writing and is currently trading around $2,653.

Major support is seen at $2,445, and any drop below this level will confirm the bearish trend. A dip until $2,300 (Feb 24th low)/$2150 would be on the cards.

An intraday trend reversal may happen if Ethereum closes above $2,775. A jump to $2,850/$3,000 is possible, but bullish continuation only above $3,300.

RSI- Neutral

One strategy would be to buy on dips around $2,500 with SL around $2,300 for TP of $3,300.

XRP/USD Daily Outlook

Intraday trend- Bearish

Key support- $0.70, $0.50

Key Resistance- $0.86 (Mar 12th 2022)

XRP’S price holds above short-term (55-day EMA) and below long-term (200-day EMA). Any breach below $0.70 would confirm further bearishness. It is currently trading around $0.76651. A short-term trend reversal would occur only if it breaches $1.02 (23rd Dec high).

It may be good to sell below $0.70 with SL around $0.80 for a TP of $0.50.

LUNA/USD Daily Outlook

Intraday trend- Bullish

Key support- $89, $75

Key Resistance- $105

LUNA/USD’s price is holding below short-term (55-day EMA) and above long-term (200- day EMA) in the 4-hour chart. Breaking above $105 would confirm further bullishness. It is currently trading around $88.35. A short-term trend reversal is only if it breaks $75.

It may be good to buy on dips around $85 with SL around $75 for TP of $130.

Bitcoin Support/Resistance

Resistance

R1- $42,600

R2- $43,500

R3- $46,000

Support

S1- $37,000

S2- $34,000

S3- $30,000

Ethereum Support/Resistance

Resistance

R1- $2,775

R2- $2,850

R3- $3,160

Support

S1- $2,445

S2- $2,300

S3- $2,150

See more at the Newsweek Cryptocurrency Index:

For full technical terms, please see our Cryptocurrency trading glossary.

from Cryptos Updates – usanewsplug Wordpress

via IFTTT